Suncorp has unveiled a corporate restructure that will see it establish a new ‘technology and transformation’ function, while disbanding its customer and digital function entirely.

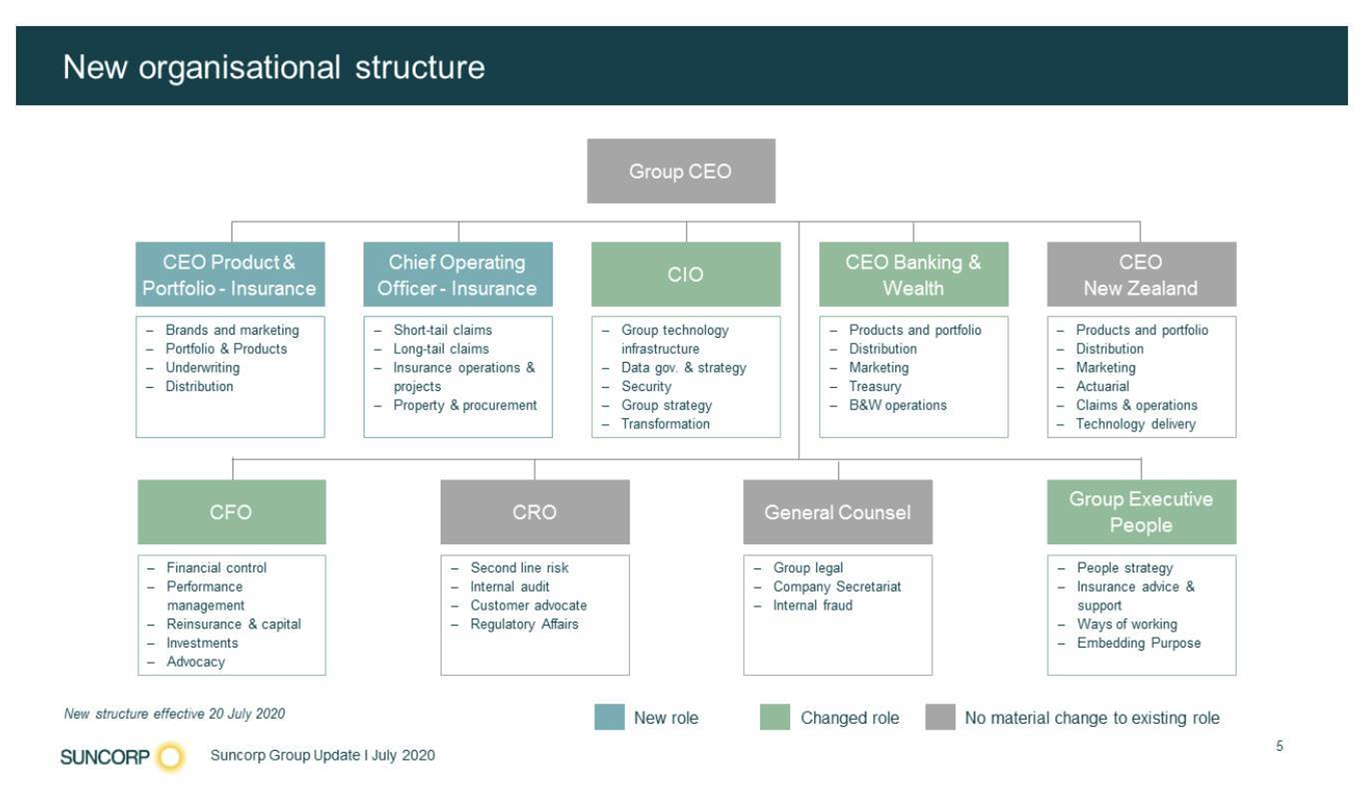

Bennett, who comes from CBA and joins Suncorp as its CIO today, will assume responsibility for group technology infrastructure, data governance and strategy, security, group strategy and transformation, according to a new org chart.

“Transformation at Suncorp will obviously be customer-led but will be technology-enabled. I think that's the case in most financial service organisations,” group CEO Steve Johnston said on an analyst call.

“In addition to maintaining the availability and security of our multiple core systems, Suncorp's CIO - as leader of the technology and transformation function - will drive a digital-first program of work across all businesses.

“This function will leverage our new ways of working and guide our digital and automation programs, working alongside our product and distribution teams in insurance, banking and New Zealand.

“Adam Bennett, who we announced a couple of weeks ago, joins Suncorp today as CIO, and he'll lead the newly created technology and transformation function. I really do welcome Adam to Suncorp.”

In addition to the establishment of ‘technology and transformation’, Suncorp will now completely disband its ‘customer and digital’ function.

“Existing teams [will be] transitioned into the operating businesses,” the company said.

Customer and digital was only set up mid last year from the ashes of internal functions led by Pip Marlow before her departure from Suncorp.

Lisa Harrison, who had been handed responsibility for customer and digital last year, will move to a new executive role in Suncorp’s insurance business.

Suncorp did not discuss its technology and transformation directions in detail today, though it noted that appetite for digital transformation had accelerated due to COVID.

In particular, where the company is headed after junking a troubled Oracle core banking system replacement project in May remains an open question.

Like other large organisations, however, it appears future large-scale IT projects are out.

Johnston said the restructure would result in savings for Suncorp generally.

"This is about the realignment of the team and refocusing the operating model to allow us to quicken up the pace of transformation," he said.

"I'd expect there will be some savings. Some of that we've got provisions sitting there in the FY20 accounts [for].

"If we come through the next part of the story, I see material opportunities opening up for us, but not necessarily huge big programs of work like we've seen at Suncorp over the past decade.

"One of the benefits that we have of doing [big programs of work] over the last decade is we've got all the tools in the organization we need to deliver these benefits.

"We've got good digital capability, good automation capability, good process improvement capability, and we've got an established offshore partner sitting with us.

"So what we need to do now is apply all the skills and assets we have in the organisation to a program of work to automate manual processes, digitise our sales and service capability on distribution and claims lodgement, and to drive material changes to the profile of our organisation over the next two to three years."

Johnston said he would look to keep the market "materially updated" on Suncorp's progress, including tying activity closely to bottom-line improvements.

"I don't want to launch a massive big program of work and have people distracted by that," he said.

"I want [our efforts] to be reflected in improved expense ratios and improved loss ratios as we move forward with better pricing and better analytics ... so that you can see absolutely how we're delivering to the bottom line."