Nib has implemented a new machine learning engine to process claims submitted via its app in less time by reducing the amount of manual data entry required behind the scenes.

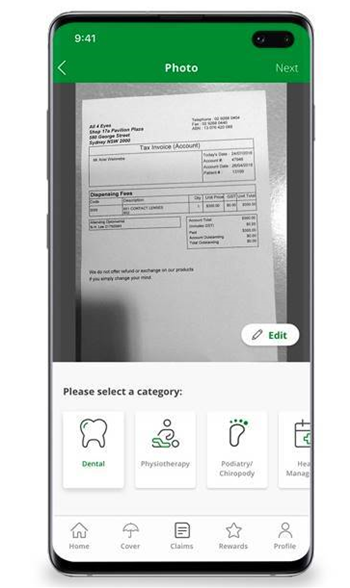

Five years ago the health insurer introduced a new feature that let members take a photo of their receipt and submit a claim via the app.

While that improved the customer experience, it became a challenge to process the information at the backend as the volumes of photos increased, said nib's CIO Brendan Mills.

“We created a great customer experience but we then also caused ourselves some pain in processing photos because we're then taking a whole heap of flat images and having to rekey all the data [such as] provider number, customer number…it was quite an intensive process,” Mills told iTnews.

For the past six months, the health insurer has been using machine learning algorithms to strip information from the photos and pass it through to the core claims processing system.

The engine, dubbed Melvin, was developed with data science consultancy Eliiza and uses AWS Textract to read the relevant information from the photos.

Mills said the process saves an average of 20 seconds handling time per claim, and about half of the claims require no further human intervention to rekey or adjust any of the fields from the image.

The insurer is now considering how to expand the service to process more claims, improve accuracy levels and determine if claims can be paid out without any human intervention.

Mills said work is underway to determine the types of claims that have a very “high confidence” level to approve automatically, possibly with a post-processing quality assurance mechanism in place.

“Of course, once you allow these things to go straight-through, you've got to be pretty confident that it's commensurate with your risk appetite," he said.

The project builds on a 2018 proof of concept, which showed promising results, warranting further investment.

More broadly the organisation is building out its machine learning skills with a dedicated team focused on building data science capabilities or platform-related capabilities for data science and machine learning.

“We believe that machine learning, data science and AI are a key component of us continuing to digitise the business,” Mills said.

“It's something we think will permeate quite broadly across the organisation and it will have a heavy focus on how we improve our member experience over the coming years.”

Mills compared it to starting the journey with cloud computing six years ago, saying “it’s as much cultural as it is about technology”.

“We're trying to make sure that it's not just seen as a centre of excellence, or a 'cool kids' club," he said.

"[Instead, we're] making sure it permeates out into the business and the data science or machine learning is a way of thinking and a way of trying to solve problems for the business, or improving member experiences.

“It’s about requiring people to think differently about how to solve problems with technology.”

.jpg&h=140&w=231&c=1&s=0)