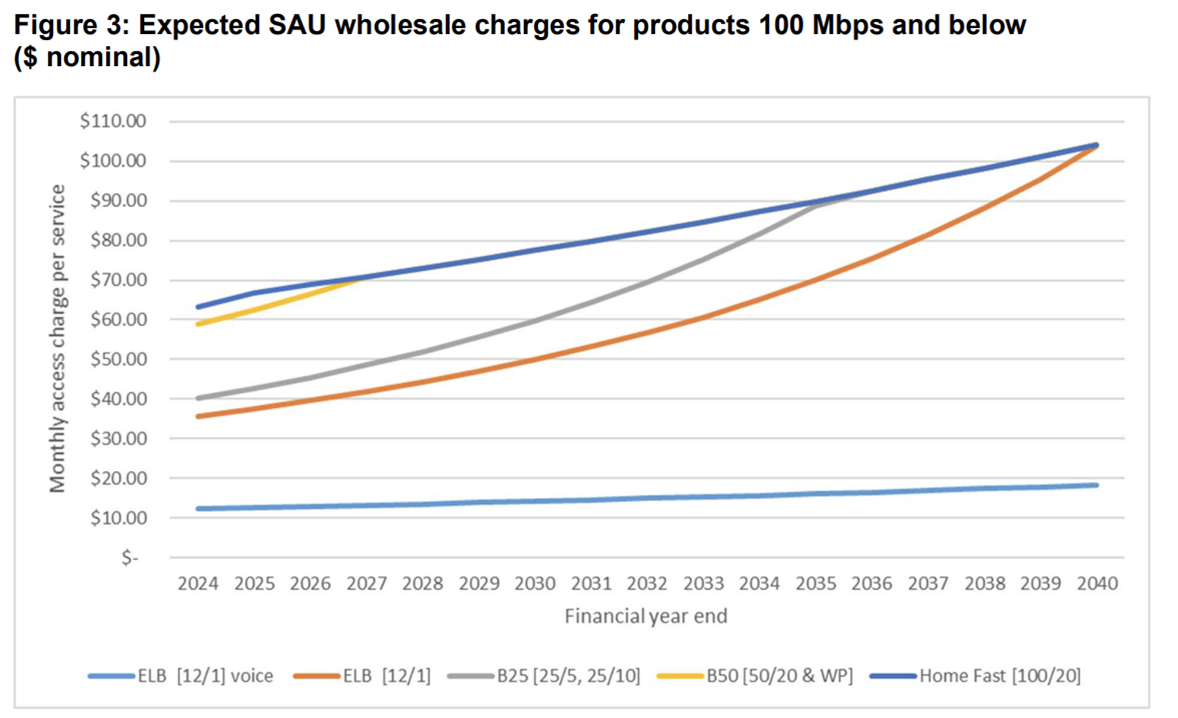

NBN Co’s 50Mbps product would cost as much as its 100Mbps product - $70 wholesale - “within only a few years”, while its cheapest products would double or more in price by 2040 if a new pricing model is waved through unchanged by the ACCC.

The Australian Competition and Consumer Commission (ACCC) sounded a warning that price hikes could be realised even sooner than that, because the commission doubts some of the broadband utilisation assumptions that NBN Co uses.

The modelling [pdf], produced by the ACCC, is the centrepiece of a consultation it has opened on a proposed new pricing model for the NBN, which would be enshrined in a revised special access undertaking (SAU).

It is the first substantive public input from the ACCC on NBN Co’s pricing proposal, which is largely unchanged since being first floated last year.

Under the proposal, wholesale pricing for 100Mbps and above tiers would be a single flat rate per month - with yearly increases at CPI plus three percent; while 25Mbps and 50Mbps tiers would be charged in the same way they are today, with fixed and variable cost components.

Flat pricing would benefit less than 20 percent of active NBN users; the vast majority would be stuck with the existing price model, which means they face regular price increases as they use the internet more.

It’s the quantum of those increases that could be difficult to stomach - both for consumers, and for the ACCC, which is being asked to sign off on them.

If pricing for 25Mbps, 50Mbps and 100Mbps converges at - or ahead of - the timescale that the ACCC expects, it could push consumers up to effectively paying for 100Mbps services, whether they have need for it or not - and potentially whether or not their lines actually support these speeds.

“We observe that the costs to retailers of the 50Mbps product are expected to equal those of the 100Mbps product within only a few years and similarly for the 25Mbps product before the end of SAU term [2040],” the ACCC said.

“Should NBN Co’s proposed pricing measures come into effect, NBN Co is forecasting a significant migration of access services from the 50Mbps and lower speed tiers to the 100Mbps speed tier with a commensurate increase in its average revenue per user (ARPU).

“It is likely to force households and businesses to purchase high speed inclusions at a price that does not represent fair value to them based on their requirements.”

The drive to 100Mbps

NBN Co said in February it is using the new pricing model in part to test how much consumers can actually pay for 100Mbps services.

The company reinforced that in a supporting submission to the ACCC.

"NBN modelling of anticipated usage requirements indicates that the 100Mbps plan will best support the broadband experience of approximately 50 percent of end users based on forecast usage within this decade," the network operator said.

"Going forward, NBN Co’s prices levels are expected to grow as willingness to pay for the network increases.

"The increased willingness to pay for broadband will be driven by increasing consumer value propositions, including ongoing and sustained increases in broadband network traffic as well as the emergence of new applications and new uses for the network (e.g., 8K TV)."

However, citing numbers from the government-run Bureau of Communications and Arts Research, the ACCC said there was a question mark over whether most households really needed 100Mbps speeds to the extent that NBN Co would like to sell those services.

“[The Bureau] forecasts that the median household speed requirement will be 29Mbps in 2028 and that 99.9 percent of households will need no more than 78Mbps,” the ACCC said.

Efficient costs

The regulator said that its modelled price rises could be realised sooner due to considerable uncertainties built into NBN Co’s pricing model.

One of its concerns - and indeed a concern of the industry - is whether NBN Co efficiently incurs its costs, and the extent to which these costs are being used to constantly drive up prices.

The ACCC said that “under NBN Co’s proposal there remains no link between underlying costs and the price structure, price levels or projected price paths.”

“Further, NBN Co’s proposed pricing and proposed price paths do not appear to contain any direct link to current or future demand,” it said.

“Rather, NBN Co’s proposed pricing appears to derive largely from an escalation of its existing pricing practices.”

The commission is consulting on NBN Co’s revised SAU until July 8. It intends to release a draft decision on the new SAU in September.

.png&h=140&w=231&c=1&s=0)