Macquarie Group's banking and financial services (BFS) division has set a goal to have all its IT infrastructure in the cloud over the next two-and-a-half years.

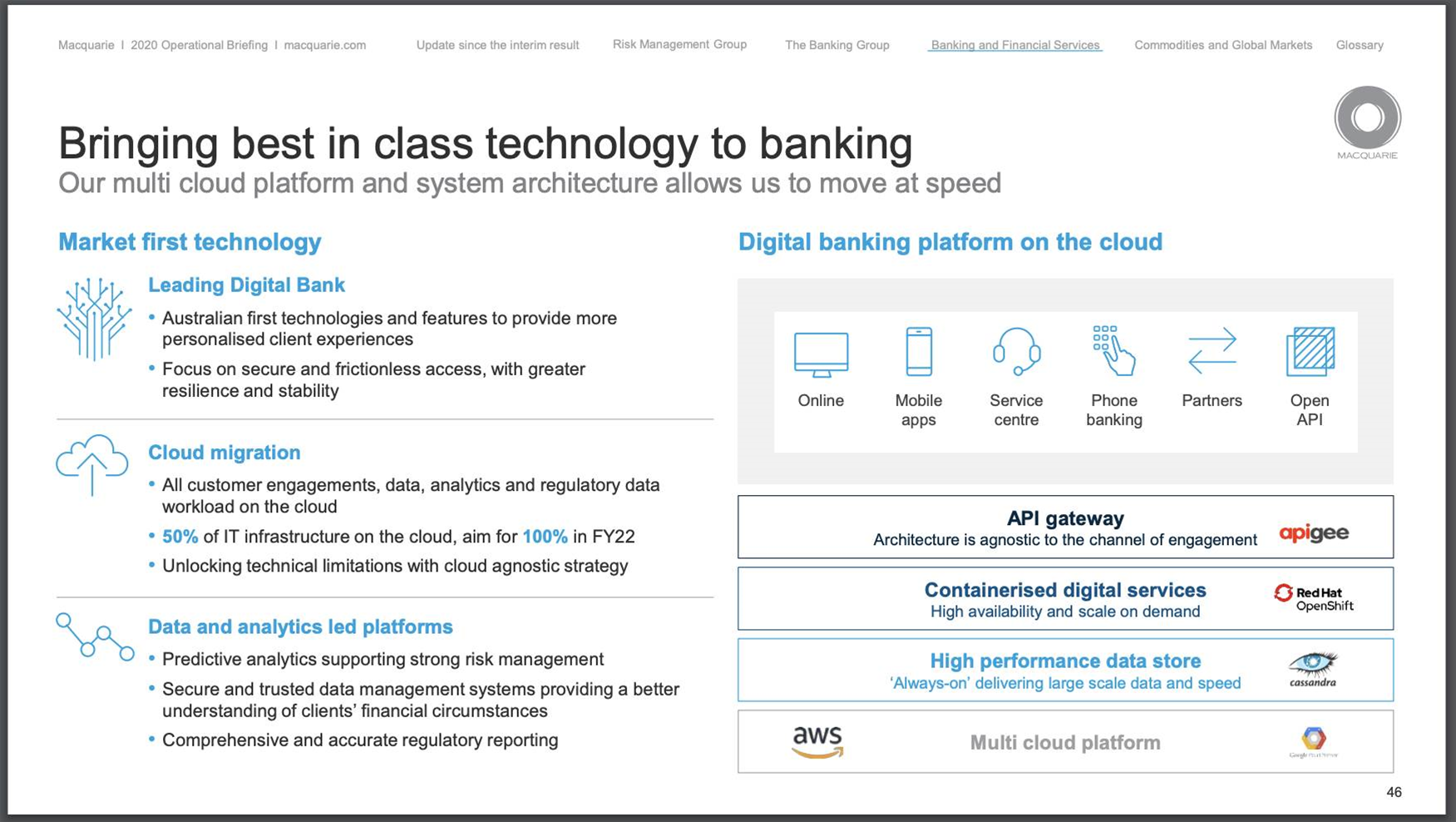

The financial group is known to be re-architecting hundreds of applications to run in containers hosted on either AWS or Google cloud under a multi-cloud migration project.

It revealed mid last year some of the behind-the-scenes work to run the cloud migration at scale, including keeping a lid on costs and resources needed to push larger numbers of applications into the cloud.

In an operational briefing for the first half of FY20, Macquarie Group's BFS division - which comprises Macquarie’s retail banking and financial services businesses - said it had “all customer engagements, data, analytics and regulatory data workload on the cloud”.

Further, it said that it now had “50 percent of IT infrastructure on the cloud” and that it is “aiming for 100 percent in FY22”.

The group said that it is “unlocking technical limitations with [its] cloud agnostic strategy”, suggesting the group’s recent move into Google cloud is paying off.

However, it was unclear how much of the group’s application portfolio is ultimately cloud-bound.

Greg Ward, group head of BFS, lauded the cloud technology stack in a financial presentation, but did not go into detail.

“We have a superb tech team and product team, and we really do have some leading technology here,” Ward said.

“[For] a lot of it, the first time it's been seen in financial services has been at Macquarie, and I think we're very sophisticated in terms of our cloud strategy as well - much more advanced than what you'll see in the industry.”

By contrast, NAB said last week that it has an end goal to be 100 percent in the cloud, though this is most likely a reference to both IT infrastructure and applications, given the bank is already pursuing a goal of migrating 35 percent of its application portfolio.

Ward said that years of simplifications and the pursuit of efficiency in BFS had enabled the division to continue to spend on technology.

“Costs over the last five years or so [are] basically flat,” he said.

“What that means is that we've been able to invest more money proportionately in technology, whilst keeping costs flat, and that technology investment is allowing us to grow at scale.”